Home >

Stock Market Crash of 1929...

Stock Market Crash of 1929...

Item # 559701

Currently Unavailable. Contact us if you would like to be placed on a want list or to be notified if a similar item is available.

October 30, 1929

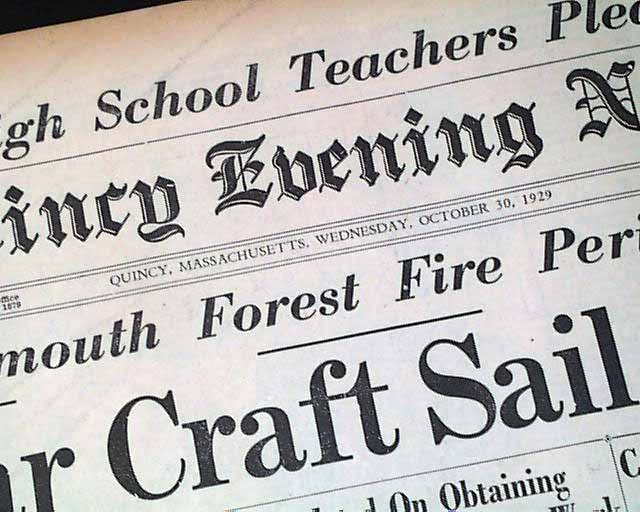

QUINCY EVENING NEWS, Massachusetts, October 30, 1929

* Stock market crash of 1929

* Post initial collapse

This 16 page newspaper has a one column headline on the front page: "Stocks Advance, Confidence Rises".

Historic reporting during the great stock market crash of 1929 that would eventually lead into the great depression. Will history repeat itself today ?

Other news of the day. Light browning with a few binding slits along the spine, otherwise in good condition.

wikipedia notes: The Wall Street Crash of 1929, also known as the Great Crash, was the most devastating stock market crash in the history of the United States, taking into consideration the full extent and longevity of its fallout.

Three phrases — Black Thursday, Black Monday, and Black Tuesday — are commonly used to describe this collapse of stock values. All three are appropriate, for the crash was not a one-day affair. The initial crash occurred on Thursday, October 24, 1929, but it was the catastrophic downturn of Monday, October 28 and Tuesday, October 29 that precipitated widespread panic and the onset of unprecedented and long-lasting consequences for the United States. The collapse continued for a month.

Economists and historians disagree as to what role the crash played in subsequent economic, social, and political events. In a 1998 article The Economist argued, "Briefly, the Depression did not start with the stockmarket crash."[4] Nor was it clear at the time of the crash that a depression was starting. On November 23, 1929, The Economist asked: "Can a very serious Stock Exchange collapse produce a serious setback to industry when industrial production is for the most part in a healthy and balanced condition? ... Experts are agreed that there must be some setback, but there is not yet sufficient evidence to prove that it will be long or that it need go to the length of producing a general industrial depression." But The Economist cautioned: "Some bank failures, no doubt, are also to be expected. In the circumstances will the banks have any margin left for financing commercial and industrial enterprises or will they not? The position of the banks is without doubt the key to the situation, and what this is going to be cannot be properly assessed until the dust has cleared away."

The October 1929 crash came during a period of declining real estate values in the United States (which peaked in 1925) near the beginning of a chain of events that led to the Great Depression, a period of economic decline in the industrialized nations.

At the time of the unbelieveable crash, New York City had grown to be a major metropolis, and its Wall Street district was one of the world's leading financial centers. The New York Stock Exchange (NYSE) was the largest stock market in the world.

The Roaring Twenties, which was a precursor to the Crash,[6] was a time of prosperity and excess in the city, and despite warnings against speculation, many believed that the market could sustain high price levels. Shortly before the crash, Irving Fisher famously proclaimed, "Stock prices have reached what looks like a permanently high plateau." The euphoria and financial gains of the great bull market were shattered on Black Thursday, when share prices on the NYSE collapsed. Stock prices fell on that day and they continued to fall, at an unprecedented rate, for a full month.

In the days leading up to Black Tuesday, the market was severely unstable. Periods of selling and high volumes of trading were interspersed with brief periods of rising prices and recovery. Economist and author Jude Wanniski later correlated these swings with the prospects for passage of the Smoot-Hawley Tariff Act, which was then being debated in Congress.[9] After the crash, the Dow Jones Industrial Average (DJIA) recovered early in 1930, only to reverse and crash again, reaching a low point of the great bear market in 1932. On July 8, 1932 the Dow reached its lowest level of the 20th century and did not return to pre-1929 levels until 23 November 1954.

"Anyone who bought stocks in mid-1929 and held onto them saw most of his or her adult life pass by before getting back to even."

Category: The 20th Century